Bitcoin Merentile Exchange commonly shortened to BitMex is a popular global exchange for Bitcoin future which accepts skillful altcoin dealers. Based in Hong Kong, BitMEX was established by Arthur Hayes, Samuel Reed and Ben Delo in 2014. HDR Global Trading Limited which is the holding company of BitMEX operates with a registration from Seychelles. I have taken time to study and evaluate the exchange elucidating its benefits as well as drawbacks. Below is the main review.

| 1. Provides beginners with helpful resources for future trading | 1. Membership not open to everybody especially US gamblers |

| 2. Effective and efficient support services through multiple means | 2. Limited options of altcoin as some were delisted due to the removal of a number of cryptocurrencies because of low trading volumes |

| 3. Stable, quick, secure and efficient services | 3. Designed for experienced traders, thus difficult for a newbie |

| 4. Users can use up to 100x leverage | 4. The mobile application is not available |

| 5. Downtime is a possibility |

Main Features of the Trading Platform

BitMEX is very popular among traders thanks to the full coverage of almost trading services. Here, the BitMEX features like the currency pairs, the trading market, banking methods. Besides there are charges applied to transactions depending on the market you trade in. All these peculiaritirs are presented here to help you become acquainted with them.

Available Markets

BitMEX is a professional platform, that operates with few markets of cryptocurrencies.So here we have 3 basic markets: perpetual swaps, futures and margin trading. Futures have different leverages depending on the crypto. Besdies each types of trading markets charges processing fee which we describe further.

Perpetual Swaps

The plain vanilla futures and perpetual swap are the 2 kinds of tradeable derivatives assets in the network. The latter does not have an expiration period. Futures normally have validity period before which they must be executed. Conversely, perpetual swap does not have any expiration just like a contract for difference or a spread betting. It is tantamount to dealing on physical instrument at spot where the displayed price equals the asset’s spot price.

The plain vanilla futures and perpetual swap are the 2 kinds of tradeable derivatives assets in the network. The latter does not have an expiration period. Futures normally have validity period before which they must be executed. Conversely, perpetual swap does not have any expiration just like a contract for difference or a spread betting. It is tantamount to dealing on physical instrument at spot where the displayed price equals the asset’s spot price.

Futures

A future contract occurs when crypto dealers agree to acquire or vend a particular asset for a fixed cost later in the course of time. BitMEX’s customers are allowed a leverage of about 100X. Each tradeable cryptocoin has its max margin on the network. Here is a list of 10 main altcoins and their maximum leverage:

A future contract occurs when crypto dealers agree to acquire or vend a particular asset for a fixed cost later in the course of time. BitMEX’s customers are allowed a leverage of about 100X. Each tradeable cryptocoin has its max margin on the network. Here is a list of 10 main altcoins and their maximum leverage:

| Leverage | Max |

| ZCash (ZEC): | 5x |

| Monero (XMR): | 25x |

| Ethereum Classic (ETC): | 20x |

| Cardano (ADA): | 20x |

| Ethereum (ETH): | 50x |

| Bitcoin Cash (BCH): | 20x |

| Litecoin (LTC): | 33x |

| Ripple (XRP): | 20x |

| Bitcoin (BTC): | 100x |

| Tron (TRX): | 20x |

Margin Trading

For margin trades, Cross-Margin and Isolated margin are 2 the good choices to pick from. In the first option, what is up for margin is all you have left in your account, whereas in the latter when one makes an order, they determine how much to utilise for that. Due to the possibility of having a negative outcome because of leverage calls, it is much preferable to use the cross-margin and high leverage.

For margin trades, Cross-Margin and Isolated margin are 2 the good choices to pick from. In the first option, what is up for margin is all you have left in your account, whereas in the latter when one makes an order, they determine how much to utilise for that. Due to the possibility of having a negative outcome because of leverage calls, it is much preferable to use the cross-margin and high leverage.

Fees Structure

The fee structure of the operator is quite uncomplicated. What determines the rate you’re charged is your role: a maker or a taker. Makers get the rebate as it amounts to putting liquidity on order books. Conversely, takers are charged given that the order books lose it. Your choice of token specifies the sum are compensated with or charged as a maker or taker respectively.

The fee structure of the operator is quite uncomplicated. What determines the rate you’re charged is your role: a maker or a taker. Makers get the rebate as it amounts to putting liquidity on order books. Conversely, takers are charged given that the order books lose it. Your choice of token specifies the sum are compensated with or charged as a maker or taker respectively.

Swap Charges

| Coin | Maker | Taker | Leverage |

| -0.0250% | 0.0750% | 100x | |

| -0.0250% | 0.0750% | 50x |

Futures Fees

| Coin | Maker | Taker | Leverage |

| -0.05% | +0.25% | 100x | |

| -0.05% | +0.25% | 50x | |

| -0.05% | +0.25% | 20x | |

| -0.05% | +0.25% | – | |

| -0.05% | +0.25% | 20x | |

| -0.05% | +0.25% | 33x | |

| -0.05% | +0.25% | 20x | |

| -0.05% | +0.25% | 20x |

Deposits & Withdrawals

Bankrolling with fiat money is not accepted. Users can only put fund into their account with BTC. The least amount to deposit is 0.001BTC while customers can take out any amount. Only one transaction is allowed per day which is manually reviewed to ensure the safety of fund. This offer is rendered charge free. The BTC blockchain charge is dependent on the network load.

Bankrolling with fiat money is not accepted. Users can only put fund into their account with BTC. The least amount to deposit is 0.001BTC while customers can take out any amount. Only one transaction is allowed per day which is manually reviewed to ensure the safety of fund. This offer is rendered charge free. The BTC blockchain charge is dependent on the network load.

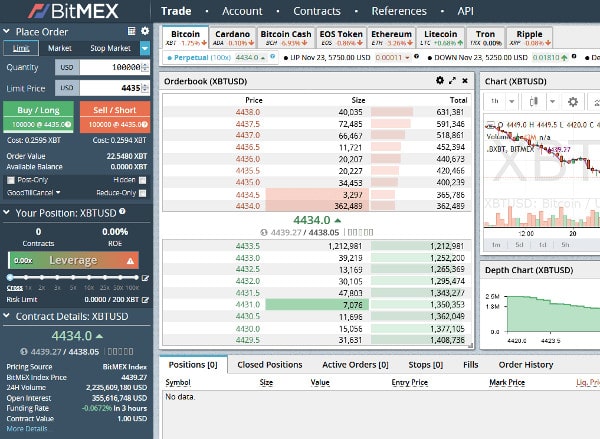

Order Types

BitMEX’s clients have choices of orders to opt for. Take a look at the list below.

- Limit: implemented at a specified price

- Market: fulfilled at the present standard price

- Stop limit: Here the execution of the stop order is at the discretion of the trader

- Trailing stop: Unlike the stop order, here the user fixes the trailing value utilized in making the market order

- Take profit limit: employed in fixing a preferred price on a trade

- Take Profit market: Unlike the previous one, here the implementation of the order is at the present flash price.

Manual on Buying Crypto on Coinmama

- Sign up. Having an account on the site does not involve complicated process, and there’s no lengthy form to fill. Only functioning email ID is required for because registration confirmation link will be electronically mailed to the inbox. Bear in mind that to be eligible for membership, you have to be of legal age (up to 18 years).

- To view the trading tools and features in order to start transacting, click on “Trade” once you are done with the profile creation process. All these instruments will appear on your screen for you to make your choice. Then take a look at the left-hand side of the screen. The order book, as well as the order slip, will be there. So you can modify the operator’s widgets to give you a better viewing experience.

- Click and make the order.

Customer Support Services

The customer care services of the operator are comparable to those other trading platforms. Users can receive support via various means including channels of social media, emails, and compliance tickets, all are offered on a 24/7 basis. Responses through these channels are within 60 minutes on average.

The customer care services of the operator are comparable to those other trading platforms. Users can receive support via various means including channels of social media, emails, and compliance tickets, all are offered on a 24/7 basis. Responses through these channels are within 60 minutes on average.